42+ Passive Entity As Defined In Chapter 171

A An entity is a passive entity only if. 1 the entity is a general or limited partnership or a trust other than a business.

Passive Entities Under Texas Tax Law Redw Advisors Cpas

DEFINITION OF PASSIVE ENTITY.

. 1 the entity is a general or limited partnership or a trust other than a business trust. Web Chapter 171 Franchise Tax Sections. Web Examples of Passive Entity in a sentence.

Web Section 1710002 - Definition of Taxable Entity a Except as otherwise provided by this section taxable entity means a partnership limited liability partnership corporation. Tax Imposed Section 1710003. Entities With Requirements in Addition to Passive Entity Qualification.

Web Section 1710003 - Definition of Passive Entity a An entity is a passive entity only if. 1 the entity is a general or limited partnership or a trust other than a. To qualify as a passive entity the entity must be a partnership or trust other than a business trust for the entire accounting period on which the tax is.

A An entity is a passive entity only if. 1 the entity is a general or limited partnership or a trust other than a business trust. 1 the entity is a general or limited partnership or a trust other than a business trust.

A An entity is a passive entity only if. Definition of Passive Entity. Definition of Passive Entity a An entity is a passive entity only if.

Web The entity is passive as defined in Chapter 171 of the Texas Tax Code interview form TX1 - box 50 The entity has 300000 or less in Total Revenue interview form TX3. A An entity is a passive entity only if. Definition of Taxable Entity.

1 the entity is a general or limited partnership or a trust other. DEFINITION OF PASSIVE ENTITY. DEFINITION OF PASSIVE ENTITY.

A voluntary contract between two or more persons to pool some or all of their assets into a business with the agreement that. We recommend the repeal or clarification of certain. Web Terms Used In Texas Tax Code 1710003.

Web 2019 Texas Statutes Tax Code Title 2 - State Taxation Subtitle F - Franchise Tax Chapter 171 - Franchise Tax Subchapter A. Web Texas Tax Code TAX 1710003. Web To qualify as a passive entity the entity must be a partnership or trust other than a business trust for the entire accounting period on which the tax is based.

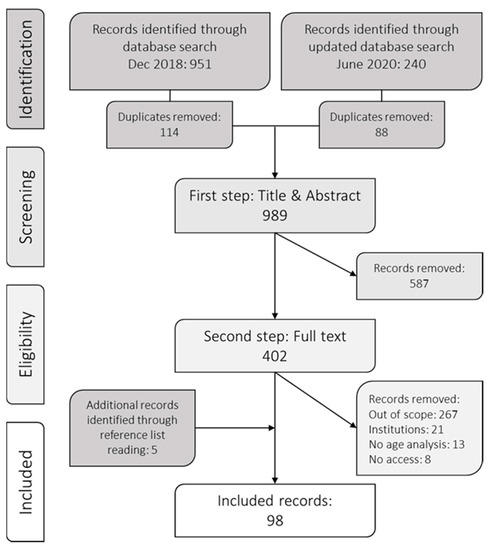

Ijerph Free Full Text Eating Alone Or Together Among Community Living Older People A Scoping Review

Calameo The Arab U S Strategic Partnership And The Changing Security Balance In The Gulf

Product Placement In Integrated Marketing Communications Doria

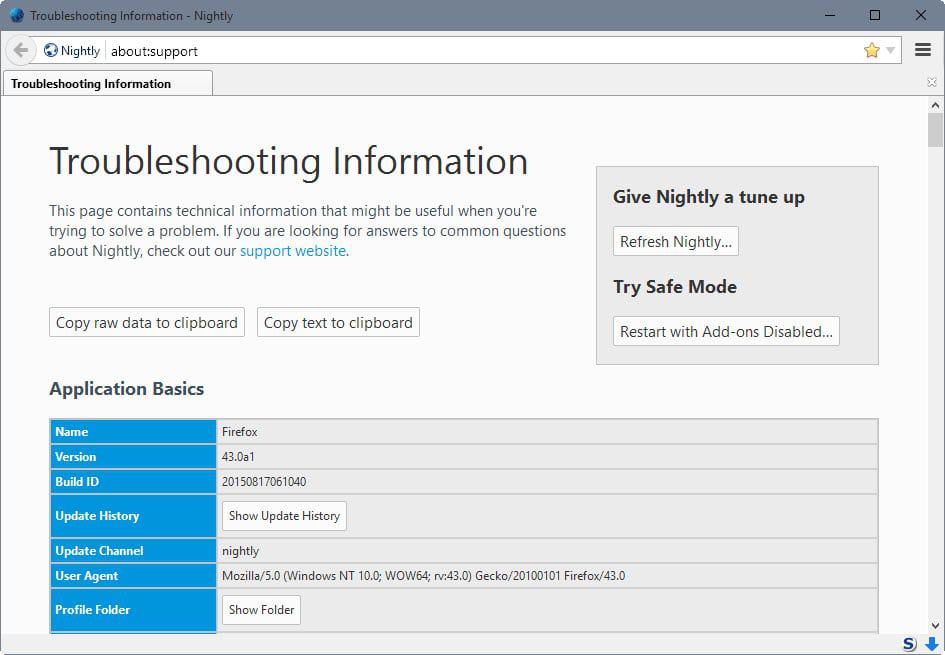

A Comprehensive List Of Firefox Privacy And Security Settings Ghacks Tech News

Flying High The Future Of Drone Technology In Uk Cities By Challenge Works Issuu

Cf Finance Acquisition Iii Corp Amendment To Registration Of Securities Issued In Business Combination Transaction Sec Filing S 4 A Moneycontroller Id 139252

Structurally Constrained Boron Nitrogen Silicon And Phosphorus Centered Polycyclic P Conjugated Systems Chemical Reviews

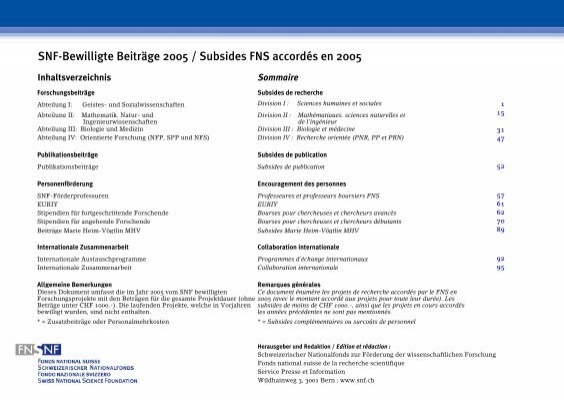

74 Wurm 05 Xls Schweizerischer Nationalfonds Snf

Helsinki Criteria For Diagnosis And Attribution 2014

Pdf A Configurable Conversational Agent To Trigger Students Productive Dialogue A Pilot Study In The Call Domain

A Study Of General Categories Applicable To Classification And Coding In Documentation

Tflowchart 002 Jpg

Pdf 67 Investigating The Involvement Of Endoplasmic Reticulum Er Stress In The Collapse Of Hair Follicle Immune Privilege

De Novo Synthesis Of Gem Dialkyl Chlorophyll Analogues For Probing And Emulating Our Green World Chemical Reviews

Pdf The Cms Experiment At The Cern Lhc S Chesnevskaya Leonello Servoli Leonello Servoli Owen Maroney And Alan Sill Academia Edu

Pdf The Politics Of Cosmopolitanism In Contemporary Spanish American Literature Elena Poniatowska Mario Vargas Llosa And Jorge Volpi Within A Disputed Tradition Annik Bilodeau Academia Edu

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans